Moreover, even after facing a 30% decrease in demand, industry leaders are required to respond to the declared energy transition efficiently. So, to defy the odds in each transformational area, they need organizational mobility, adaptability, and a structured approach to achieve the low carbon future objectives.

Low carbon energy and the net zero agreement

Let’s recall the UN Paris Agreement, where 196 countries agreed to reduce greenhouse gas emissions and attain net zero by 2050. Although many companies thought it would take years to attain the necessary technology to accomplish such a goal, transitional companies have already started. For example, Denmark has already ended oil and gas production in the North Sea by canceling all upcoming licensing rounds. Furthermore, ExxonMobil’s carbon objective strives to diminish the impact of upstream greenhouse gas emissions by up to 20% over the next five years while investing in lower-emission technologies.

Contrary to popular belief, there are a variety of approaches to achieving a lower carbon future. As industry leaders are quickly shifting to more effective financial models, we recommend considering the following changes:

1. Make core hydrocarbon businesses more resilient

First, oil and gas organizations should develop a project set that can withstand both reduced crude prices and increased carbon costs. Second, keep in mind that current portfolios can enhance their emissions performance and profitability by removing the least effective yet most carbon-intensive wells and related facilities. Finally, remember that strengthening a portfolio’s climatic and financial resilience requires focusing future investments on resources that offer an optimal mix of lower break-even pricing and reduced carbon intensity.

2. Expand into low-carbon markets

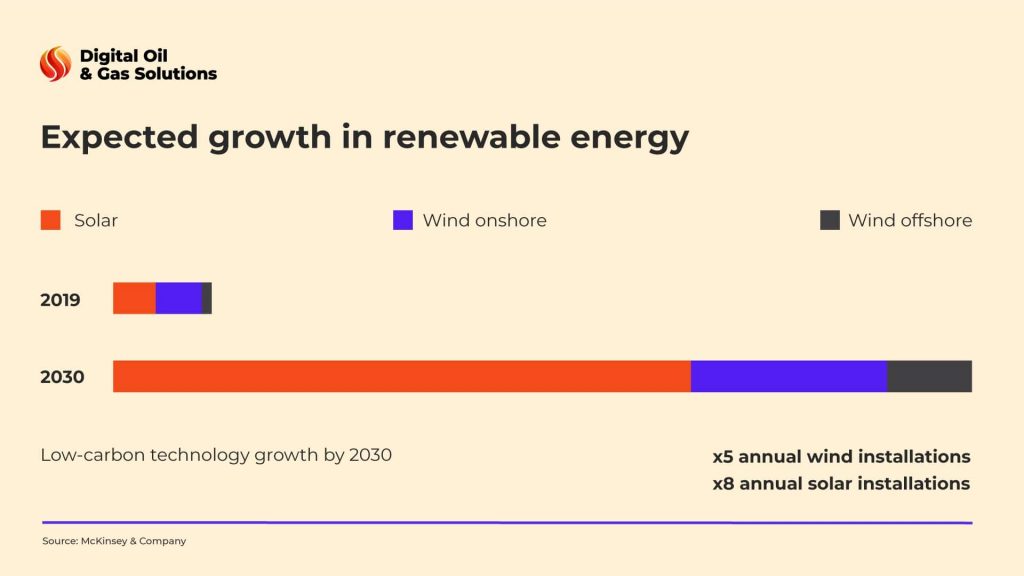

The world has agreed to keep global warming between 1.5 and 2.0 Celsius degrees above pre-industrial levels. So, over the next ten years, all sectors of the global economy will need to drastically reduce emissions to attain a 1.5-degree route. As a result, low carbon technologies like renewable power, bioenergy, carbon trading, direct air capture, and others represent potential growth markets. Knowing where to invest is important, but how businesses invest and perform is vital too.

3. Become agile to prosper in a low-carbon world

The future of the oil and gas industry in a low carbon world depends on corporations working hard to update their strategy and reallocate capital. Meanwhile, are they doing enough to alter their business models? Change isn’t always easy, and we know that. However, companies should start with assessing their current operations, mapping out short-term plans, reimagining their overall business strategy, and preparing carefully to compete in the many low carbon energy areas. Only after a thorough analysis and planning leadership will be able to reinvent their long-standing operating patterns and work toward new skills, management, and mindset.

How can oil and gas companies find growth options in low-carbon businesses?

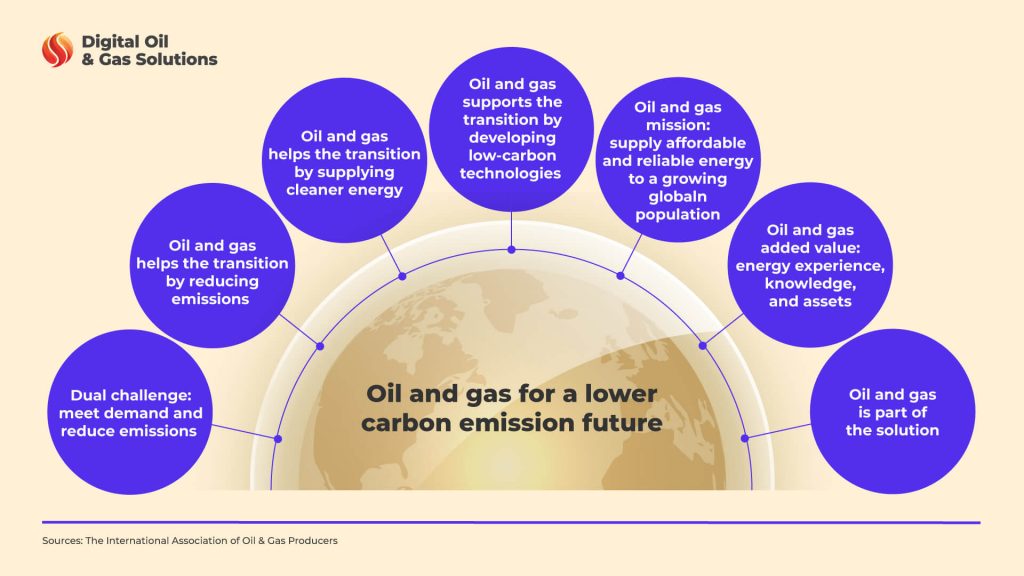

As companies become highly interested in finding expanding alternatives to embrace a low carbon future, it’s essential to understand how crucial low carbon technologies are. By using renewable and innovative solutions, companies can be protected against demand risk while decarbonizing their operations. They can also use their supply chain and business growth knowledge to help low carbon energy distribution in the overall energy transition. In addition how oil companies approach the low carbon energy transition may affect how governments, stockholders, and communities perceive them.

The main goals of oil and gas companies when moving towards a low carbon future can be divided into the following categories:

For top performers, the mature stage of any industry’s growth is often the most lucrative. Although the demand is dropping, companies in this category count on a future where a meaningful necessity for hydrocarbons will last for another 30 years. In general, independent companies are the ones not rushing to embrace the low carbon future.

Such businesses want to keep their thriving core while also seizing some of the significant advantages of low carbon technologies. A clear case is BP, an oil giant that has recently revealed its transition from an international oil corporation to an integrated energy company ready to face the low carbon future.

Steps to increase your competitive edge

Oil and gas leaders need to envision and drive the low carbon future and energy transition to reap the benefits of their efforts. Simply trying to survive the low carbon lifestyle won’t yield profit. So, investors are becoming decisive directors of emission reductions as they are more aware of the hydrocarbon demand range. They are also turning their focus to the environmental impact of oil and gas production through Environmental Social Governance (ESG) financing. To give a good account of oneself, we suggest the following steps:

- Discover financial models in low carbon business, elaborate on strategies that reduce carbon emissions while maintaining revenues, and communicate these methods to stakeholders. For example, profits from circular or sharing economy-based business models are estimated to reach $335 billion by 2025. Ensure that your preferred model is aligned with the problem your company wants to solve profitably. Keep in mind that innovating business strategies doesn’t always mean creating new products or processes. It can suggest a shift in how a company manages its finances, interacts with consumers, or organizes its supply chain.

- Measure your carbon footprint to discover and manage the source and magnitude of your greenhouse gas emissions and start tracking them over time. This assignment can raise awareness of climate change issues within your organization and pave the way for a more in-depth examination of the opportunities and risks you may face. In addition, acknowledging the environmental challenges each company experiences helps businesses develop and integrate new potentially profitable products.

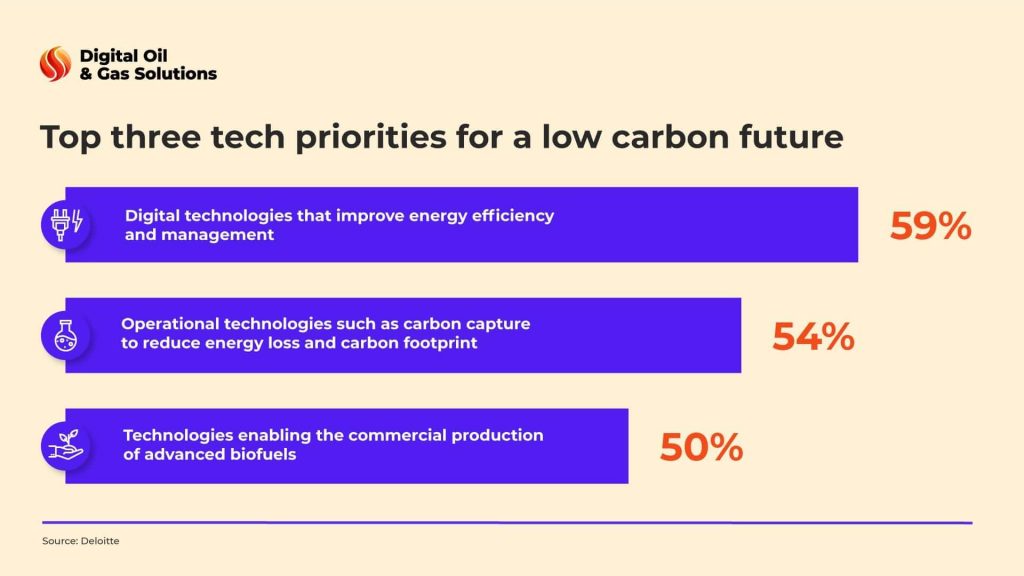

- Invest in the concept of net zero emissions by acquiring low carbon technologies to have a smooth transition. As companies try to reduce or even eliminate their production of carbon dioxide and other greenhouse gases, technology seems like the correct answer to these issues. For example, AI and ML solutions can collect, structure, and analyze large amounts of data from various sources to unleash unique insights and ways to solve problems. Additionally, they can boost global productivity while lowering overall emissions. Meanwhile, digital twins allow for better energy resource monitoring, predictive maintenance, and effective remote management. Investments in innovative technology are crucial to remain committed to a low carbon lifestyle.

- Evaluate your company’s direct and indirect influence on the environment and consider how those risks could harm your organization or improve it. Consider the monetary impact that comes from what currently emits a lot of carbon dioxide and assess how climate change might affect your revenue and costs. In some cases, climate change could result in higher raw material costs, investments in new facilities, or even additional tax liabilities. Your capacity to transfer these expenses to consumers through new price structures will impact your revenues. Therefore, managing that structure while exploiting new business opportunities and maintaining market share will reshape your organization.

- Design and introduce a strategic action plan supported by the knowledge you have acquired from evaluating risks and opportunities for your companies’ new low carbon life. These changes can range from evident savings in energy use and carbon emissions to complete renovation of your current operations. First focus on decreasing climate-related risk exposure and identifying business possibilities within those risks. As you do that, remember to demonstrate the efforts of the oil and gas industry to the next generation of talent who are worried about the industry’s ESG impact and risks.

The inevitable era of low-carbon energy systems

The transition to net zero emissions is happening faster than earlier industrial revolutions. There’s absolutely nothing anyone can do to stop it. Fortunately, when combined with the correct technologies and regulations, industry leaders get a variety of decarbonization options to achieve the planned goal of low carbon fuel and even net zero emissions by 2050.

Our experience in the industry allows us to analyze and emphasize the importance of acquiring tailored IT solutions for companies to reach their objectives and stay in the game. The global demand for oil and gas is projected to decrease from 90 million to 24 million barrels per day by 2050. These statistics eliminate any possibility of future development. So, the ambition to remain profitable will force industry leaders to constantly look for a good oil investments opportunity and make sustainable decisions now to compete in the future.